‘Fonds de commerce’: the unique French lease concept explained

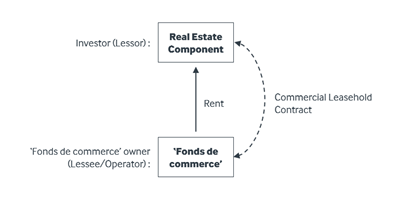

The concept of ‘fonds de commerce’, a French specificity, is so unique that there is no translation of this term in any other language. There is no legal definition of ‘fonds de commerce’ but a doctrinal and jurisprudential definition according to which a ‘fonds de commerce’ is formed by a set of assets belonging to a distinct legal entity and which includes: - tangible items, such as equipment, goods and machinery, - intangible elements, such as customers, goodwill, and the trade name.

Business. Built around You.

Your expert business property advisers

The ‘fonds de commerce’ exists whether the hotel operator owns the building in which his activity is carried out or not.

When the operator does not own the building, he benefits from a commercial lease that allows him to carry on his business. The commercial lease (together with the prerogatives it offers) forms part of the ‘fonds de commerce’.

In the latter case, the nature of the ‘fonds de commerce’ cannot be appreciated without knowing the specificities of the French commercial lease, which is also often considered mysterious by foreign investors. Indeed, it has unique characteristics compared to European or Anglo-Saxon commercial leases, particularly with regard to its duration and the right it confers on the lessee to obtain the renewal of the lease upon its expiry.

The French Commercial Lease

- Duration

While in most European countries commercial leases have a duration of 15 years or more, the French lease contract is usually concluded for 9 years and rarely exceeds 12 years. This nine or 12-year period is made of three or four triennial periods commonly called “3-6-9” or “3-6-9-12”.

A contract of more than 12 years can be concluded but this is rarely the case, as a longer lease term requires the contract to be concluded by a public notary and a payment of tax for land registration in addition to the notary's fees.

It is however possible to reach a commitment of longer duration than 12 years, by concluding a side agreement between the Lessor and the Lessee constituting a unilateral promise to lease. A sort of ’put option’ and ’call option’ that the lessor and the lessee can exercise at the end of the lease.

In the absence of an agreement between the parties when the lease is signed, the lessee alone may terminate the lease before its term, at every triennial period without compensation, with a six-month notice period.

However, if the lessee terminates the lease at the end of the three-year period, he loses his ‘fonds de commerce’. In addition, the lessee must keep all the hotel's staff or make them redundant at his expense. Finally, he must return the property in accordance with the inventory of fixtures drawn up when the lease was taken out. Needless to say that it does not often happen in hotels as the cost of terminating the lease agreement in unaffordable.

Moreover, it is common for the lessee to waive this three-year termination option and for the parties to agree on a firm term of nine or even 12 years.

The lessor cannot terminate the lease before its term, which is at least nine years, unless the lessee is at fault, and he obtains a court order to terminate the lease. Alternatively, he may seek for an amicable termination agreement with the lessee in return for compensation.

What happens upon expiry of the lease agreement?

Another specific feature of the French commercial lease is the lessee's right to benefit from a new contract at the end of the lease and thus to be able to continue his activity. Failing the renewal of the lease agreement, the lessor must pay an eviction indemnity. This right of renewal is known in French as ’propriété commerciale’, translated in English to ’commercial property’.

Two options must therefore be considered at the end of the lease:

- the lessee does not exercise his right to renewal, then the lease ends, the lessee loses his business and must vacate the premises without compensation,

- the lessee notifies the lessor of a request for renewal and then the lessor could either:

- refuse the renewal and then must pay the lessee an eviction indemnity to compensate for the loss suffered from the eviction (there are some rare exceptions). The amount of the eviction indemnity corresponds to the market value of the business and the removal and relocation costs of the evicted lessee. Once again, in the hotel industry, this option is rarely seen due to the potential litigation between the parties to reach an agreement,

- accept the renewal in which case a new lease agreement is concluded. The parties must agree on the level of the new rent, under the conditions explained below.

2. Rent

The parties have complete freedom to set the rent from the time the lease takes effect. The rent may be fixed, variable or a combination of both. It may also include a ramp up period which is often the case for hotels.

The parties may include an indexation clause providing for the annual variation of the rent, which is set according to the variation the commercial rent index (ILC as for ‘Indice des Loyers Commerciaux’ in French).

To be valid, the indexation clause must meet several conditions: the variation of the index must be without a cap or a floor, and a specific periodicity must be applicable as well as a pre-agreed revision.

If the parties have not defined the terms of the rent review or if the indexation clause is challenged, then the triennial review mechanism is applied.

However, the triennial revision cannot exceed the variation of the quarterly reference index, i.e. the quarterly commercial rent index (ILC).

In the event of renewal of the lease, the parties have the same freedom to set the rent as at the time of conclusion of the lease, if this was provided for in the original lease. If no such provision has been made, and if the parties do not agree, the new rent will be set by a court decision. The rent will then be determined according to the ‘hotel method’, which considers different parameters such as the daily income, the annual income, the occupancy rate, or other incomes according to the hotel’s classification.

3. Guarantees

Similarly to other European countries, when signing a commercial lease, particularly for a hotel business, several types of guarantees may be required such as a security deposit, a bank guarantee, or a corporate guarantee if the parent company is solid enough. Lately, we have also observed insurances guarantee, which is comparable to the bank guarantee but issued by an insurance company which will receive a premium. Insurance guarantees require to immobilise a smaller sum than a bank guarantee for the same amount of guarantee. In some cases, it is also possible to use the ‘fonds de commerce’ as guarantee.

4. Renovation works, Property taxes and other charges

These charges that can be passed on to the lessee are subject to special regulation since 2014 (Loi Daubin). In application of this regulation, it is possible to make the lessee bear all expenses and taxes generated by the ownership of the leased premises. However, expenses related to major repairs (mentioned in Article 606 of the Civil Code) and asset management fees related to the collection of rents must remain the responsibility of the lessor.

In all cases, the distribution of charges between the lessor and the lessee must be the subject of clear and detailed wording in the agreement failing which a court decision might consider the clause null and rule in favour of the lessee.

II. The ‘fonds de commerce’

In the hotel industry, when the lessee does not own the building in which the hotel is operated, he becomes the owner of the ‘fonds de commerce’ either by acquiring an activity carried out under an existing lease agreement or by creating this activity following the conclusion of a new lease agreement.

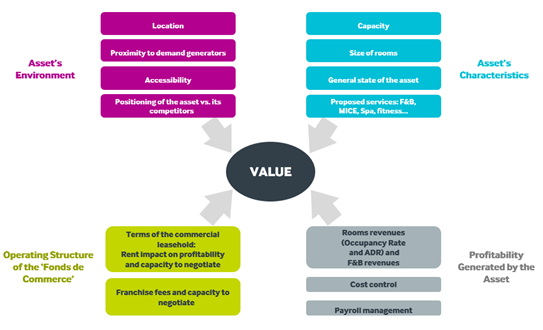

The value of a ‘fonds de commerce’ is determined by the various elements that have a direct impact on the turnover and profitability of its operation, as well as by the rent negotiated between the lessor and the lessee.

We will develop the valuation of a business and the most appropriate methods for estimating this value in the next chapter.

Three main methods can be used in hotel ‘fonds de commerce’ valuation:

- Sales Multiple Method

- Income Capitalisation Approaches

- Comparison Approach (or Market Approach)

1. Sales Multiple Method

This approach consists of applying a multiplier to the revenues generated by the operations of the ‘fonds de commerce’ during the year preceding the valuation date. If the studied asset has sufficient operating history, this is usually done by calculating a weighted average of the turnover generated by the last two or three operating years preceding the valuation date.

There are different ways of estimating ‘fonds de commerce’ valuation multiples. Generic multiples are published regularly in France, the reference in this respect being the 'Mémentopratique Evaluation' (Francis Lefebvre publishing company), which provides ranges of multiples by asset class (hotel, bar, shops, and others). These multipliers can also be determined by the comparison approach (see part iii.) by dividing the sales price by the revenues generated by the ‘fonds de commerce’.

- Limitations: Mainly used by the tax authorities, it does not reflect the factors influencing the profitability of the business, especially the operator’s ability to control costs and payroll expenses, nor the terms of the commercial leasehold negotiated between the lessor and the lessee, in particular the level of rent. In addition, as hotel activity has fallen since 2019 due to the COVID-19 pandemic, turnover figures recorded in the hotel sector are abnormally low. In addition, the pandemic-related discounts observed on hotel ‘fonds de commerce’ transactions since 2020 did not correlated with recorded drops in revenues. Therefore, the sales multiple method is not appropriate in the current context.

2. Income Capitalisation Approaches

This method analyses the income generated by the ‘fonds de commerce’. We usually focus on EBITDA as financing costs, taxes, depreciation, and amortisation that do not have an impact on the ‘fonds de commerce’ intrinsic value (we are talking here about an asset valuation and not a share valuation).

Several approaches exist, the main ones being the EBITDA multiple or capitalisation approach, and the discounted cash flow approach (DCF).

- EBITDA Multiple (or capitalisation) Approach

Like the Sales Multiple method, the EBITDA Multiple Approach consists of applying a multiple or a coefficient to the EBITDA generated in the year preceding the valuation date (or an average of the generated EBITDAs in the two or three financial years preceding the valuation date). Either we apply a multiple to the EBITDA, or we divided it by a coefficient (= 1 / EBITDA multiple), more commonly known as the capitalisation rate and expressed as a percentage.

Compared to the Sales Multiple method, this approach considers the entire profit and loss account, the operator's ability to control costs efficiently and its capacity to generate profits after the rent payment.

- Limitations: This approach also shows its limitations in times of crisis for the same reasons explained above with the Sales Multiple method. To estimate the right ‘fonds de commerce’ value, the EBITDA considered must be representative of market norms. Once again, by considering the valuation multiples applied before 2020, we observe that corresponding sales discounts on ‘fonds de commerce’ transactions since 2020 are not correlated with recorded EBITDA levels.

- DCF approach

More complex than the previously mentioned methods, the DCF approach is based on the development of free cash flows projections generated by the operation of the ‘fonds de commerce’. The DCF corresponds to a financial model which consists of making operating projections (turnover, operating expenses, EBITDAR, rent and EBITDA) over 5 to 10 years. These are based on the asset’s performance assessment within its market. An annual investment reserve corresponding to FF&E is generally deducted from the projected EBITDA to obtain the Net Operating Income (NOI). This NOI constitutes the free cash flows that will be plugged in the DCF calculation.

Two parameters are used in this approach:

- The discount rate: it is used to discount each cash flow projection to the date of the valuation,

- The capitalisation rate (or exit yield): it is used to estimate the exit value that corresponds to the sale’s price of the ‘fonds de commerce’ at the end of the last projection year (year 5 or 10 depending on the duration of the projections) using the same calculation method as for the EBITDA capitalisation approach. The estimate of the capitalisation rate is based on the inherent characteristics of the asset (environment, intrinsic qualities, operating mode) and on the rates applied to comparable ‘fonds de commerce’ transactions.

This approach is particularly useful and appropriate in the current crisis. As the levels of revenues and profitability generated by hotel ‘fonds de commerce’ are abnormally low, it allows the modelling of a post-crisis recovery period, thus allowing to estimate a value that accurately represents market practices at the time of the valuation.

- Limitations: This approach requires the valuer to be able to develop detailed hotel operational projections (business plans), which requires a thorough knowledge and expertise of the sector. In addition, the lack of transparency of the French hotel investment market makes the assessment of discount and capitalisation rates more complex and requires the valuer to have access to an exhaustive transactions database.

3. Comparison Approach

This approach can be directly aligned with market practices in terms of ‘fonds de commerce’ transactions. It consists of comparing the subject property with a list of recent transactions of assets that share the most characteristics (location, positioning in terms of category, management, state of maintenance, investments, mode of detention, etc.) including operational results (if available). The metric used for this method is the price per room (price per key). Depending on data availability per transaction (concerned hotel revenues and EBITDA), it is also possible to estimate transaction multiples. However, it is important to note that it is impossible to find two hotels with the same characteristics. An exhaustive comparable transaction list will sense check the price per key range of the hotel being studied.

- Limitation: French transaction market’s lack of transparency and the unique character of each asset makes it difficult to obtain solid comparable. Indeed, most transactions are carried out by family offices whose activity lacks transparency. As with the DCF method, this approach requires access to an exhaustive database.

To obtain the most accurate value estimate, we recommend a combination of the DCF method and the Comparison Approach, which makes it possible to compare the value driven by the DCF with market practices.

We would like to thank, Pierre Popesco, Partner at Bryan Cave Leighton Paisner for his kind contribution to this article.

Sources: CCI, BPI, Business Immo, Christie & Co Research & Analysis

If you want to know more about French lease agreement or ‘fonds de commerce’, get in touch with our French Hotel team: https://fr.christie.com/en-gb/