What makes a dental group, and why are they in such high demand?

Paul Graham, Head of Dental at Christie & Co, shares his insight into dental groups throughout the UK, and what you can do if you're considering building a dental group.

Business. Built around You.

Your expert business property advisers

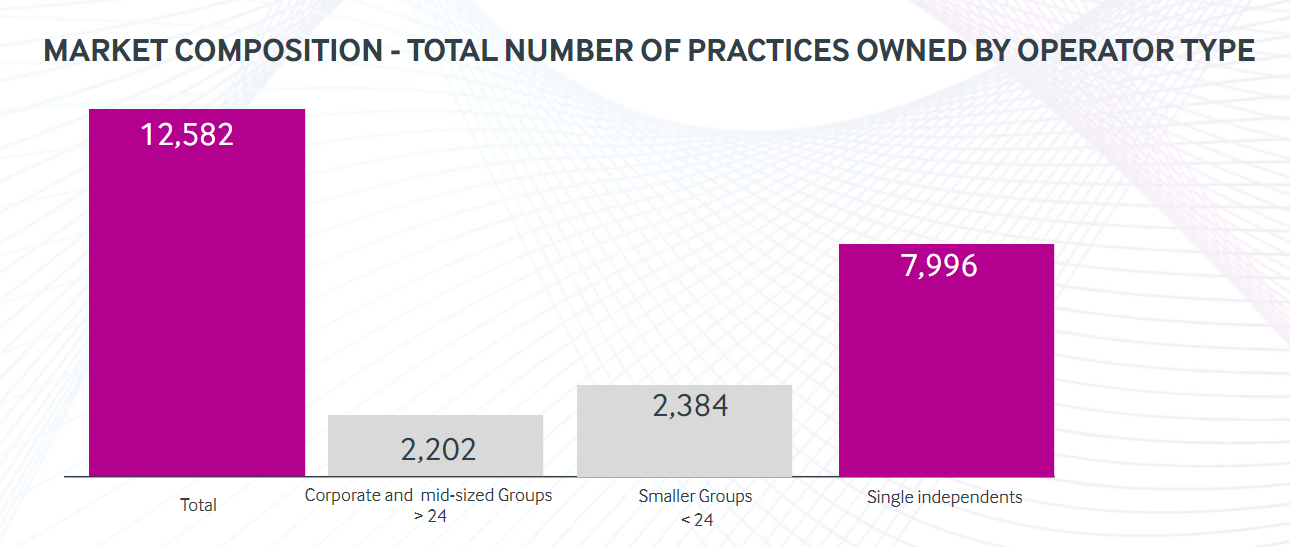

The dental market is highly fragmented; there are approximately 12,600 dental practices in the UK, 63.6% of which are independently owned, 18.9% are owned by over 800 small groups (those with between two and 20 practices), and 17.5% are held by corporates.

Established corporate and various mid-sized groups, typically with Private Equity (PE) backing, are continuing to fulfil their ambitious ‘buy-and-build’ targets through the execution of rapid acquisition plans.

Unsurprisingly, given the huge scope for consolidation within the dental market, the most active buyers are the independently owned small groups that are trying to grow to platform size. In many cases, the mid to long-term plan is to become suitable for future PE backing themselves, or indeed to be significantly attractive to existing corporate groups who wish to acquire a segment of the market in one fell swoop.

But what makes a dental group versus just a group of dental practices?

At Christie & Co, we’ve been privileged to act on behalf of some of the largest independently owned dental groups in the UK. Along with providing consultancy advice and formal RICS valuations, our specialist teams have led competitive sale processes which have resulted in existing corporates acquiring and/or Private Equity investment being received to accelerate growth of an existing platform.

When most dentists hear the phrase ‘platform’, they immediately think of the physical asset and number of sites that form the group. However, there are far more important factors that revolutionises a ‘group of dental practices’ into becoming a true ‘dental group’.

Infrastructure, foundation, and heritage

The highly scalable nature of dental services through regional expansion, and the strong potential returns from such scaling, makes the dental industry highly attractive to equity investors seeking a ‘buy and build’ platform.

To build a platform you need the virtual infrastructure required to operate a dental support organisation. Beyond the number of individual sites, a platform allows for key functional areas that support, drive, and monitor the business (both clinical and non-clinical). Investors are looking for reputational heritage, sustainability, human resources, and in-house management teams to support accounting, finance, legal, marketing, IT, and efficiency - basically everything you could imagine new investors (PE or Corporates) would need to scale up a dental group.

We meet with many founders who have created a group of dental practices but have fallen short of satisfying the requirements of a ‘true’ dental group. Taking specialist advise from a trusted advisor and broker on this growth journey is imperative. Based on previous group sales handled by Christie & Co, we can map-out and illustrate the buyer demand, challenges, and parts of your business that should be finely tuned to become highly attractive and valuable to the investor market.

Having a full-scale central operating platform that allows the business to sustainably run without the day-to-day management of the owner is the backbone of any investment worthy dental group. Crack this, and the results when selling or finding a co-investor will be extremely rewarding.

Demand and Activity

As was reported in our Dental Market Review 2022, the value of sale prices in the UK dental sector rose by 8.6% last year, showing a growing incentive for owners to sell if they’re ready. We also reported a 24% increase in buyers registering their interest in acquiring a dental practice.

Despite global uncertainty and the rising costs of running a business amid soaring inflation, dealmaking in the UK dental sector has proven extremely resilient over the past 18 months. Record levels of activity were recorded during 2021, a trend that is continuing unabated in 2022, with strong revenue growth and a range of different buyer types helping to drive a wave of activity across all practice types, including consolidation at the top end of the market.

It was announced at the end of August that Portman Dental Care and Dentex are set to merge. As two of the UK’s largest dental groups, the news has generated a significant amount of interest in the sector and beyond. Both groups have experienced rapid growth over the last few years and all information provided about the deal would suggest there are no plans to slow down.

Appetite for successful UK dental groups

It’s commonplace that dental groups that are up for sale receive an influx of interest from a range of buyers and investors. Here are some examples of recent deals we’ve completed on, which showcase true appetite for such successful groups…

Hanji Dental Group is a successful, mixed income dental business with a total of 88 surgeries spread across 18 trading dental practices in Birmingham, Manchester, Staffordshire, South Yorkshire, and the East Midlands. Earlier this year, it was sold to Riverdale Healthcare in a fast five-week-long deal brokered by our dental specialists. With the tenacity and agility of the buyer and seller, along with quite remarkable hours put in by the lawyers, we were able to conclude one of the largest dental transactions in recent times in little over a month. The deal-time is potentially ground-breaking for the industry, and highlights how being fully prepared for a sale, and having the right advisory team in place, can make for a smooth and speedy process.

Last year, we advised on the strategic investment in Scottish dental group, Real Good Dental, from private equity firm, TriSpan. This was a landmark transaction within the UK dental space and indeed for our team at Christie & Co. Real Good Dental sits within the top 10 dental operators in the UK in terms of aggregate number of practices owned. Supported by our consultancy team, we began advising Real Good Dental during the midst of the COVID-19 pandemic and, despite the obvious flux within the market at that time, it was reassuring to see significant interest from the investors we approached, it really underpins the strength of the dental market.

Earlier this year, Real Good Dental and Enamel Dental Group merged in what was a landmark deal for the sector. Since it was established in 2017, Enamel Dental Group has grown rapidly through a focused acquisition strategy, and now comprises a total of 64 surgeries across 17 trading practices across the UK, from Surrey to Sheffield. This landmark deal was backed by TriSpan and Keyhaven Capital Partners, and marks RGDC’s move into the dental sector in England, complementing its portfolio of practices north of the border. Following the merger, the two companies will continue to run independently, with all practices maintaining their existing branding and current management teams.

In September 2017, we were instructed by the owner of Avsan Holdings Limited to handle sale negotiations between him and his intended buyer, Bupa Dental Care. The highly fragmented group included 16 quality mixed practices in locations as far south as Hampshire and as far north as Aberdeen. A price was secured that was well in excess of the owner’s original expectations. Heads of Terms were agreed shortly after, and an intensive due diligence process was undertaken with Christie & Co project managing every aspect of the deal. From Heads of Terms being agreed to completion the deal took less than eight weeks.

If you are considering building or selling a dental group and would like a confidential chat about your options, contact Paul Graham: paul.graham@christie.com / 07739 876 621