90th Anniversary Timeline

2025 marks a significant milestone for Christie & Co, as we celebrate 90 years of unparalleled expertise in advising, valuing, and selling businesses across our specialist sectors.

Since 1935, we have been at the forefront of the market, providing expert advice and delivering exceptional results for our clients. We opened our first office on Baker Street in London, and have since expanded our services internationally, becoming market leader in our respective sectors.

Our 90th anniversary is a celebration of the people who have shaped our business and those who continue to drive it forward. Christie & Co’s success is built on a tradition of excellence, innovation, and a relentless focus on delivering for our clients. We look forward to seeing this continue into the years ahead.

Scroll through to see some of our highlights from the past 90 years and a few anniversary messages from longstanding clients.

Darren Bond

Global Managing Director

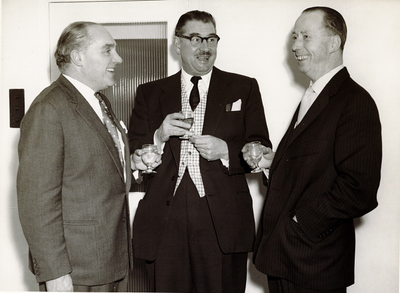

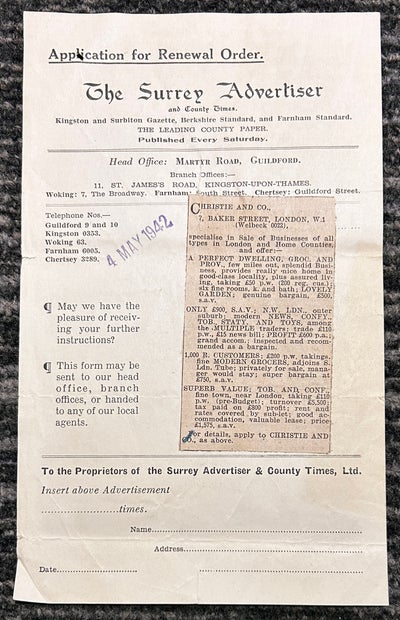

1935

Company founded

On May 8th 1935, James Owen, Nick Davies and George Christie pooled their resources to establish a business agency then called Christie, Owen & Davies in Baker Street.

![]()

1935

First major deal

Christie, Owen & Davies sold Charles Forte his first "milk bar", the Strand Milk Bar in Regent Street, London.

![]()

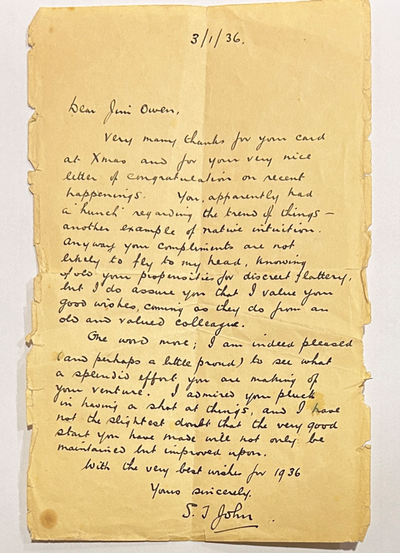

1942

Earliest record of an advertisement published

One of our earliest advertisements that was posted in The Surrey Advertiser.

![]()

1952

First regional expansion

We started to expand with our first regional office in Exeter, before opening further offices in Bournemouth, Hove, Ipswich, Cheltenham and Canterbury.

![]()

1952

Sold Egon Ronay his first restaurant

Facilitated the sale of the Marquee in Knightsbridge to the Hungarian restaurateur and journalist.

1972

Sold Waterside Inn to Roux Brothers

Sold the Berkshire-based French cuisine restaurant to the Roux Brothers, Michael and Albert.

![]()

1974

Philip Gwyn and Brian Kingham

Philip Gwyn and Brian Kingham were appointed to the Board after the acquisition of Christie & Co.

![]()

1977

Christie & Co appears in Scotland

Opening a new office in Edinburgh marks the first Scottish office.

1977

Christie Finance and Christie Insurance launched

A finance and insurance arm launched: Reliance Consumer Credit, which would later become Christie Finance and Christie Insurance.

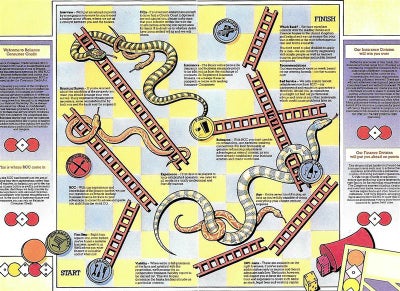

![]()

1980

Christie Group launched

A new holding company is created to unite Christie & Co and its sister businesses, this entity would later become Christie Group plc.

1985

Upgrades and expansions

Offices open across Birmingham, Bristol & Manchester, while our first computer systems are installed.

1988

Christie Group listed on the stock market

Christie Group plc floats on the London Stock Exchange, marking its debut as a publicly listed company.

![]()

1998

Paris office opens

Our first international office opens in continental Europe.

![]()

1999

Frankfurt office opens

Building on our European expansion, we launched our first German office.

![]()

2000

Barcelona office opens

We entered the Spanish market, extending our brokerage and advisory services to Southern Europe.

![]()

2004

Sold Dolphin Nursery Group

Facilitated the sale of four nurseries from Southern Cross for £12.6 million.

2005

Listed on AIM

Christie Group transfers its listing to the Alternative Investment Market, a move aimed at fostering growth under a more flexible framework.

2005

Cannon Capital Group Holdings

Sold entire share capital of Cannon Capital Group Holdings, a company which held the freehold interest in 91 care homes, for around £365.5 million.

2006

Sold Hilton Metropole

Demonstrating our capability in high-value transactions, the Hotels team brokered the £417 million sale of the London and Birmingham-based hotels in Tonstate Group.

![]()

2008

Pharmacy sector launched

Our first Medical sector was established with the launch of our Pharmacy brokerage sector.

![]()

2009

Project Pentagon

468 pubs were sold over a three year period giving us our then largest single fee.

2010

Vienna office opens

A presence is established in Central Europe with a new office in Austria.

![]()

2013

Dental sector launched

Growing on the demand following many dental practice valuations, we officially launched our Dental brokerage team, which quickly become, and remains, market leader.

![]()

2015

80th anniversary celebrated

We celebrate our 80th anniversary with the motto "80 years of business insight".

2015

Project TCG

Completed the sale of 53 pubs, with a value of around £105m, to Stonegate Pub Company on behalf of Tattershall Castle Group.

2019

Project Space

We sold Houstons Dental Group, at the time one of the UK’s largest and most respected independent groups.

![]()

2019

Project Douglas

In a landmark deal we sold 146 properties on behalf of Wyevale Garden Centres.

![]()

2020

Darren Bond becomes Global MD

Darren joined Christie & Co in 2001 and was appointed Global Managing Director in 2020.

![darren_bond_christie_com.jpg]()

2021

Skegness Pier sale

Sold for £3 million, eventual buyer and the MD of the Mellors Group, James Mellors Snr noted, "When Christie & Co were appointed, we were in touch straight away."

![]()

2023

Project King

Believed to be the largest recent independent dental deal in the UK, we facilitated a landmark partnership between North East-based dental business, Queensway Group and Dentex.

![A portfolio of four dental property investments in the North East of England.]()

2023

Project Thorpe

Full portfolio of 34 Whitworth Chemist pharmacies brought to the market, all of which were put under offer by 2024 after a sales process involving over eight prospective buyers.

![]()

2023

Care in Germany

We expanded into new territory with the Care sector in Germany.

![]()

2024

Project Watership

The sale of a long-established, highly respected family-owned portfolio comprising four prestigious nursery schools, the renowned Pippa Pop-ins, to Dukes Education.

![Pippa Pop-ins Nursery Schools in London]()

2024

Care in France

After the successful launch of our Care team in Germany, we expanded into France.

![david_alberti_christie_com.jpg]()

2024

Project Echo

Acting on behalf of Boots UK we have offered for sale multiple pharmacies, including 75 sales in 2024 alone.

![]()

2025

90th anniversary

2025 marks a significant milestone for Christie & Co, as we celebrate 90 years of unparalleled expertise in advising, valuing, and selling businesses across our specialist sectors.

![]()