Hotels France

In this section, we explore the French hotels market in 2024 and provide predictions for the sector in 2025.

Market Overview

In 2024, the French transaction market was good, with volume estimated at €2.5 billion, largely driven by the Parisian market, estimated at €1 billion, especially thanks to big operations in Paris e.g. Pullman Paris Tour Eiffel for €330 million, the Hilton Opéra for €240 million, the Dame des Arts and the Mandarin Oriental for €205 million.

The need for liquidity by some major players in the real estate market has affected the hotel sector, which remains more liquid than others. With the sudden rise in interest rates in 2023, the investment market is clearly more oriented towards value-add within a lack of ‘core’ players, and SCPI players exclusively positioned on brick assets only which have had to increase their return expectations and see their assets depreciate and lose liquidity. However, the strong easing carried out by the BCE at the end of 2024 should soften this trend in 2025. Hotel business fund owners were overall less exposed thanks to their operational performances which made it possible to offset the negative financial impacts. Across France, from an operational point of view, the Olympic Games generated an unstructured year with an underperformance before the games from June to mid-July, and an overperformance during the Olympics, representing an additional turnover of €357 million* in professional accommodation (excluding online platforms). This represents an increase of 1.4% in the sector’s annual turnover.

Another unpredictable element we saw in 2024 was the dissolution of the National Assembly and a 'wait and see' attitude may continue into 2025 as the new governments in France and the UK take power, as well as another Trump presidency in the US.

*Source: MKG Consulting

Guillaume Garcin

Managing Director - France

Key Market Trends

As of 31 March 2024 compared with figures taken on 31 March 2023:

Economic Pressure

The targeted inflation rate, set to reach 2.0% in France by 2025 (European Commission, 2024), motivated three consecutive interest rate cuts to reduce the cost of debt and stimulate economic activity. However, this period has also been marked by political uncertainty due to the dissolution of the National Assembly. With the new government composition lacking a majority, additional pressure is weighing on the French economy. Despite these challenges, the hotel industry remains robust. Profit conversion is showing a positive trajectory, supported by the decrease in energy costs in 2024, combined with top-line growth driven by above-inflation gains in room rates.

Consumer Trends

2024 will remain marked by the Olympic and Paralympic Games (JOP) in seven French cities, resulting in fluctuations in RevPAR gains showing signs of stabilization or consolidation. The JOP have also accelerated the recovery of international air traffic, with a remarkable 27.7% growth year-to-date from January to September 2024 compared to the same period in 2023 for the Asia-Pacific region. Overall, the rising trend in tourism spending has led to significant gains for the tourism sector, estimated to account for 9% of the French GDP in 2024, up from 4% in 2019 (WTTC).

Sector Funding

Political uncertainty in France might dampen investor appetite. However, the sector has successfully refinanced in 2024, and with interest rates declining, the trend is noticeably reversed. Investors are eager to invest even more in the hospitality industry, new funds dedicated to hotel investment are expected to appear on the market. With over 100 hotel transactions in France by Q3 2024, the interest of institutional investors to penetrate the market demonstrates that hotel assets continue to spur interest from a diverse panel of investors who were not previously considering this asset class.

ESG

Following the implementation of the Décret Tertiaire in late 2023, investors are spending more time studying the ESG implications when assessing deals. This regulation aims to reduce energy consumption in tertiary buildings, aligning with sustainability goals. As lenders become more stringent on ESG criteria to unlock financing, assets demonstrating strong ESG compliance are likely to benefit from lower costs of debt and will be better positioned to capture the upcoming drop in interest rates.

Market Sentiment

We anonymously surveyed hotel business owners across the country to gather their views on the year ahead.

Market Predictions 2025

- Despite a return to a normal year without major events, demand should stabilise through more international arrivals, particularly from Asia, boosted by the success of the JOP, spotlighting Paris.

- The ’upscaling’ trend will continue to maintain low room growth (+0.2% CAGR 2019-2023) as small underperforming properties close or renovate, contributing to occupancy stabilisation.

- Institutional investors are expected to return to the hotel market, while owner-operators will continue their positive investment trajectory, seeking operational leverage.

- High interest rates and office market downturn challenged real estate developers, creating opportunities for redeveloping tertiary projects or building new hotels in VEFA structures.

Case Studies

Operator Search - Les Chalets du Mont d'Arbois - Megève - 40 rooms 5 stars

Christie & Co’s office in Lyon supported Edmond de Rothschild Heritage in its operator search for the historic asset located in the heart of the French Alps. The 40 room, five-star Chalets du Mont d'Arbois is now operated by Beyond Places.

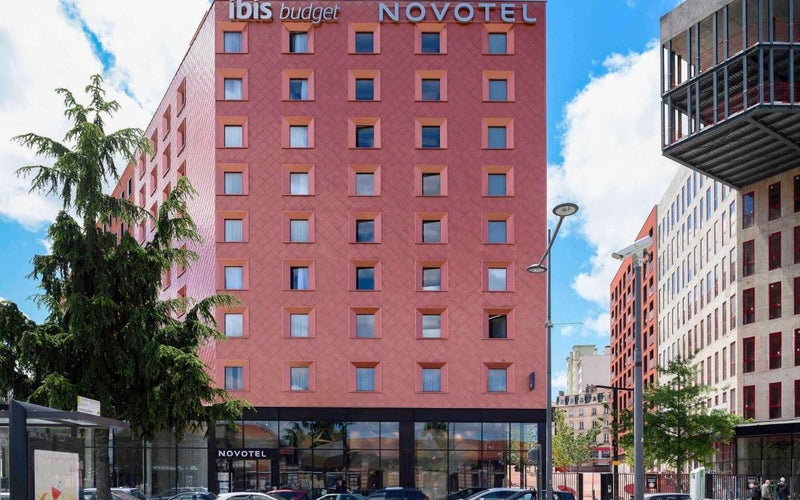

Saint Étienne portfolio - 220 rooms 2&4 stars

Exclusively mandated by Extendam, Christie & Co’s office in Lyon supported the sale of a strategic hotel portfolio including; Novotel Saint-Étienne Centre Gare Châteaucreux, ibis Budget Saint-Étienne Centre Gare Châteaucreux and ibis Budget Saint-Étienne Stade, in Saint-Étienne for the benefit of the HERA Invest group.

Mercure Toulouse Sud - 90 rooms - 4 stars

Christie & Co’s Bordeaux office supported the HIS group in the acquisition of the Mercure Toulouse Sud hotel within a very strategic location, built in 2015 and designed by architect Jean-Paul Viguier.

Major Transaction from 2025

| Date | Business | Purchaser | Details |

| Mar | Hilton Paris Opéra Paris | City Developments Limited | 268 rooms Sold €240 million |

| Mar | Mandarin Oriental Paris | Gruppo Statuto | 138 rooms Sold €205 million |

| Mar | Hôtel Dame des Arts Paris | Sono Hospitality | 109 rooms Sold €115 million |

| Apr | Pullman Tour Eiffel Paris | Morgan Stanley / QuinsPark Investment | 430 rooms Sold €330 million |

| Jul | La Pomme de Pin Courchevel | OCP | 50 rooms Sold €65 million |

| Jul | Le Pilgrim Paris | NC | 53 rooms Sold €48 million |

| Jul | Maison Breguet Paris | Financière M.P. Landowski (FMPL) | 50 rooms Sold €46 million |

| Oct | Hôtel Sinner Paris | Experimental Group + private | 43 rooms Sold €53 million |

| Oct | Portfolio of 23 hotels | Swiss Life AM, Amundi, B&B Hôtels | 1797 rooms Price NC |

| Nov | Saint James & Albany Paris | Mohari Hospitality, Omnam Group | 144 rooms Sold €200 million |