A glance at UK hotel transaction data and trends, as investors approach the finish line

Our Hotel Consultancy team explore transactional activity in the UK up to the third quarter, pinpointing trends and opportunities.

Business. Built around You.

Your expert business property advisers

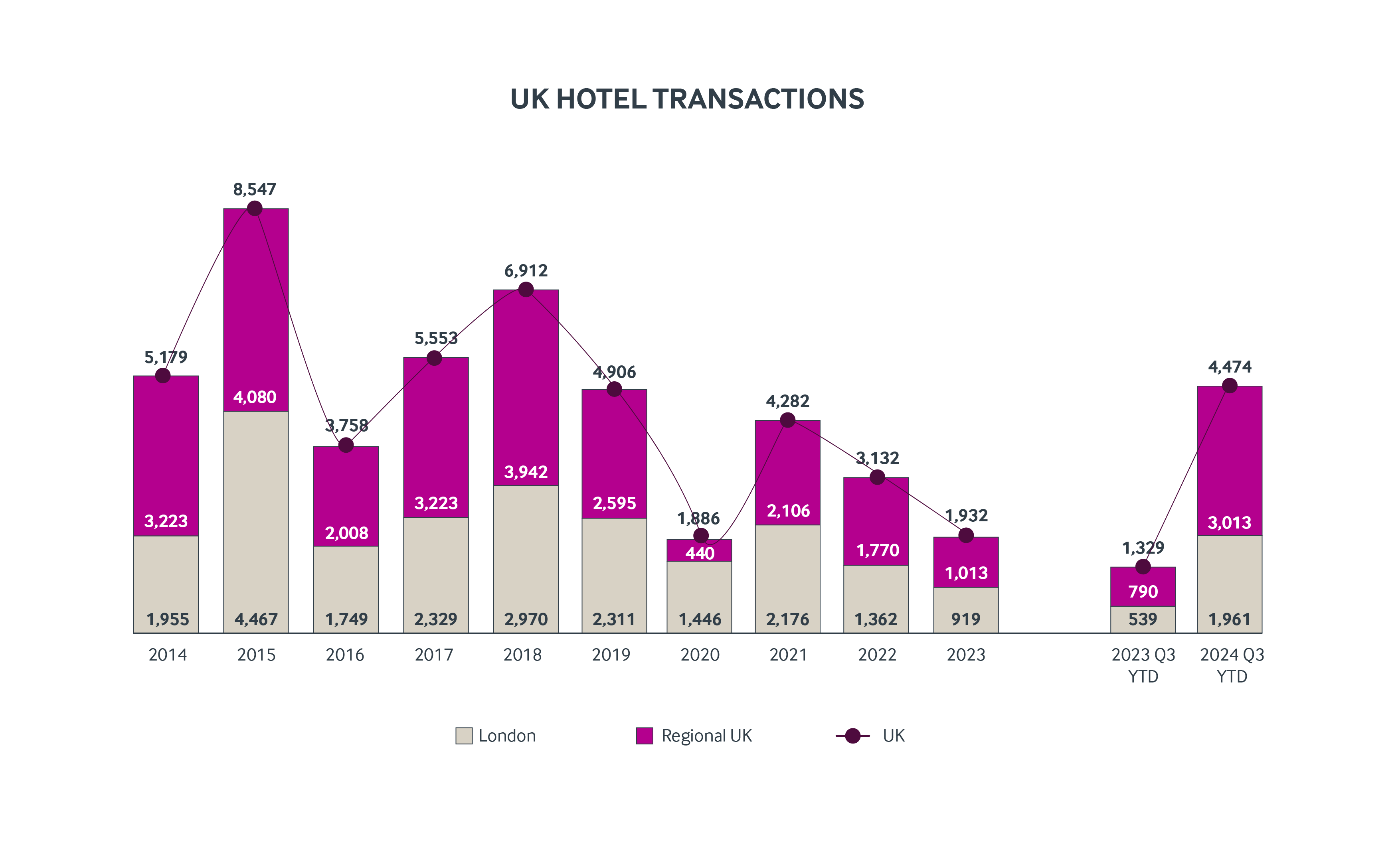

2023 hotel transactional activity ended roughly on par with 2020, but marked a further decline on 2021 and 2022 levels, despite combining a fair balance of transactional volume between Greater London and Regional UK. However, the UK is finally on the rebound and has reclaimed its crown as the backbone of the European transaction market, registering 38% of the £13.3bn of hotels transacted in Europe in 2024 Q3 year to date (YTD), and over 2.5 times the full year volume of 2023. 2024 is visibly on the rise, surpassing 2019 and 2021 annual transaction activity, supported by a slight compression in yields, attributable to the stabilisation of the trading environment and progressive reduction in financing costs, thus narrowing the price gap between sellers and buyers.

Note: This graph displays UK Hotel Transaction Volume (£m) 2014 – 2024 Q3 YTD, as of 20 November 2024: it includes transactions £2.5 million and greater. Sources: MSCI Real Capital Analytics https://app.rcanalytics.com/, Christie & Co Analytics

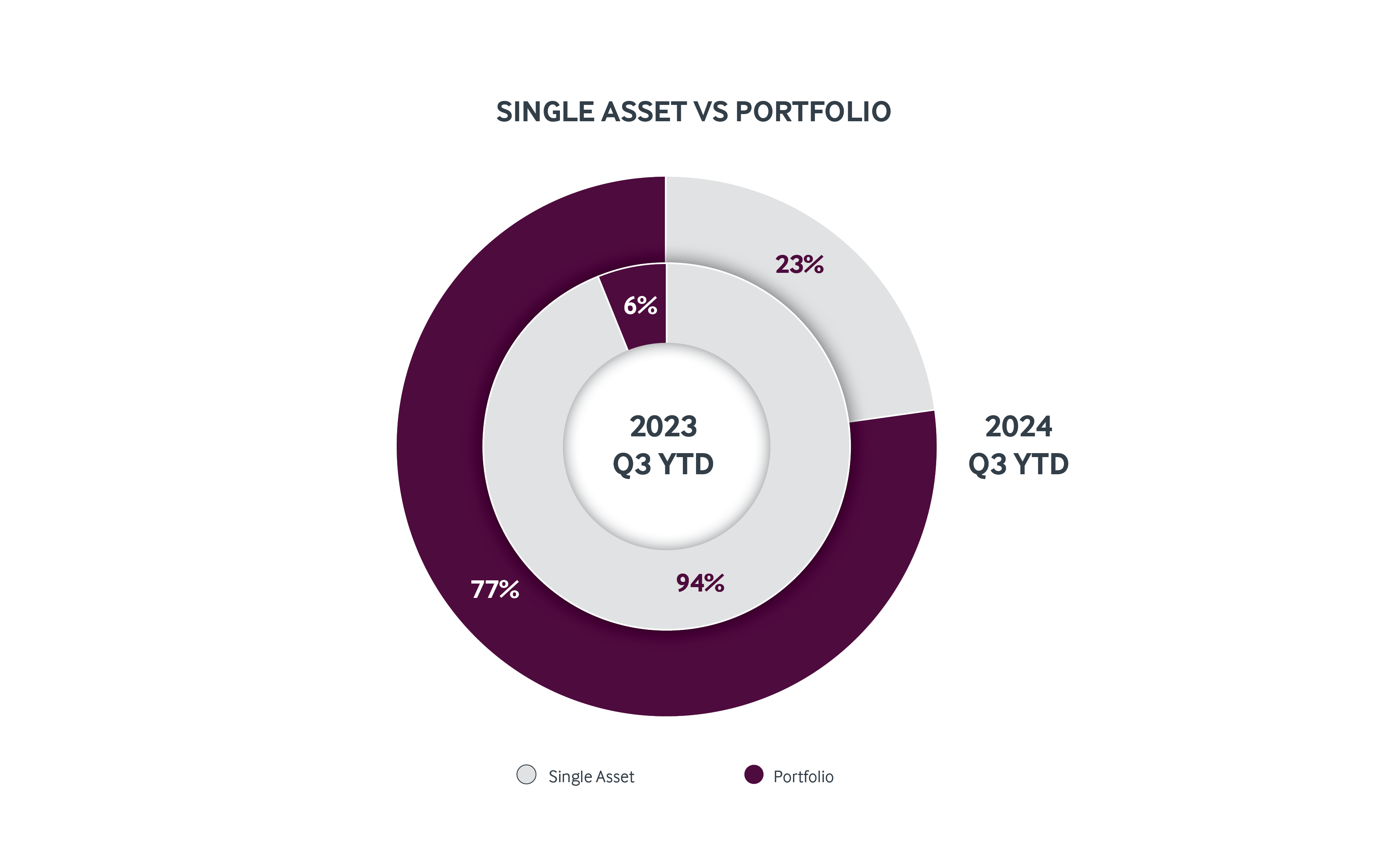

The distribution of transaction volumes between London and the regions shows only slight change from 2023 Q3 YTD. Despite marginal gains for Regional UK, portfolio-led activity maintains an even geographical distribution. The resurgence in transaction activity was driven by several portfolios and institutional and private equity investors, including Starwood Capital's purchase of 10 Radisson Edwardian, Ares' purchase of the LandSec Accorinvest portfolio, Village Hotels being acquired by Blackstone and Travelodge's purchase of 66 freehold hotels from LXi REIT. As a result, nearly 80% of transactional volume was portfolio linked during Q3 YTD, a mirror image of the previous year. Whilst single assets are still transacting, they only represented about £1.1bn worth versus £3.8bn worth of portfolios.

Note: This graph displays the UK Hotel Transaction Volume Mix, Single Asset vs Portfolio 2023 Q3 YTD – 2024 Q3 YTD, as of 20 November 2024. Sources: MSCI Real Capital Analytics https://app.rcanalytics.com/, Christie & Co Analytics

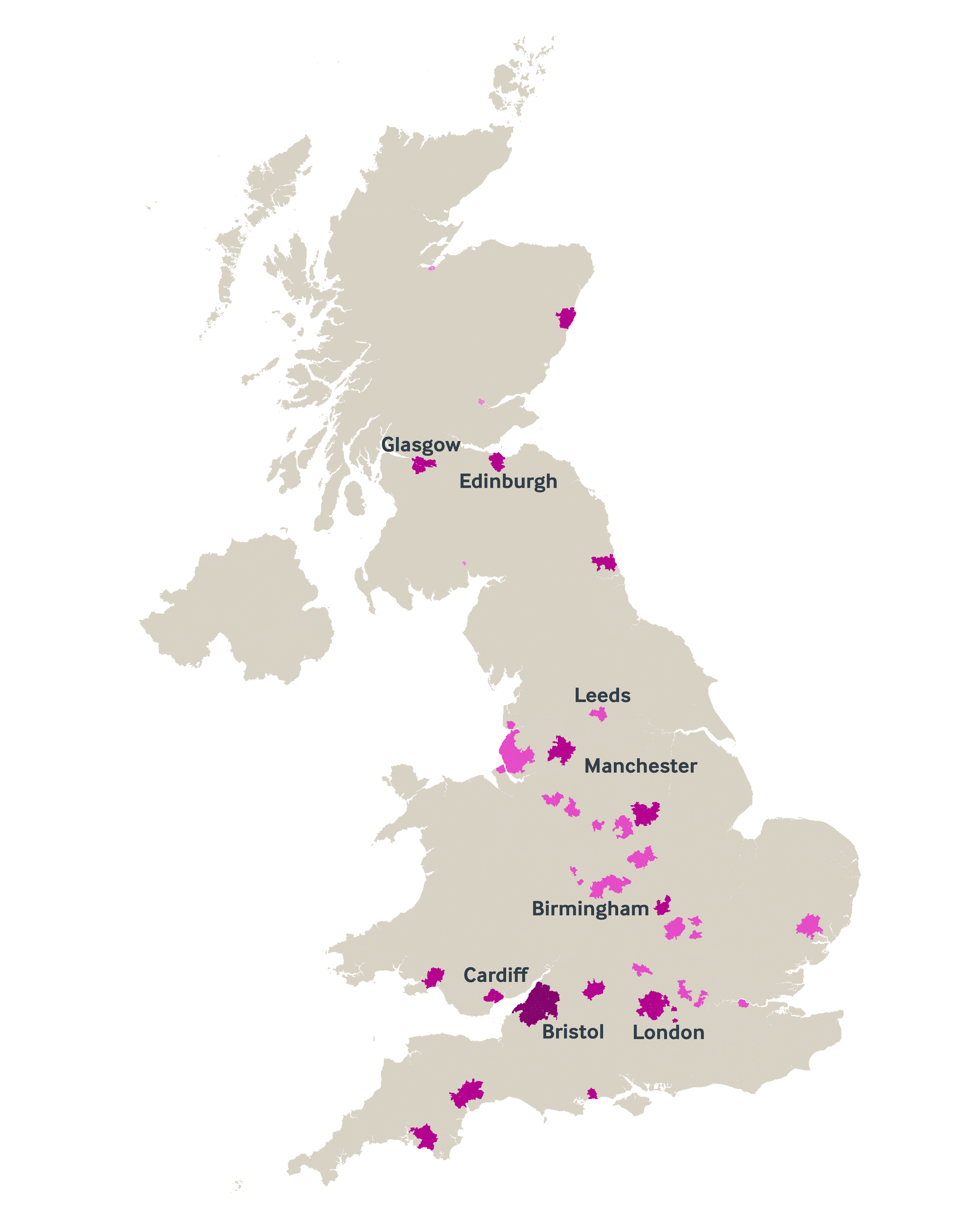

Note: This graph shows Portfolio Transaction Occurrences 2024 Q3 YTD, as of 20 November 2024. Sources: MSCI Real Capital Analytics https://app.rcanalytics.com/, Christie & Co Analytics

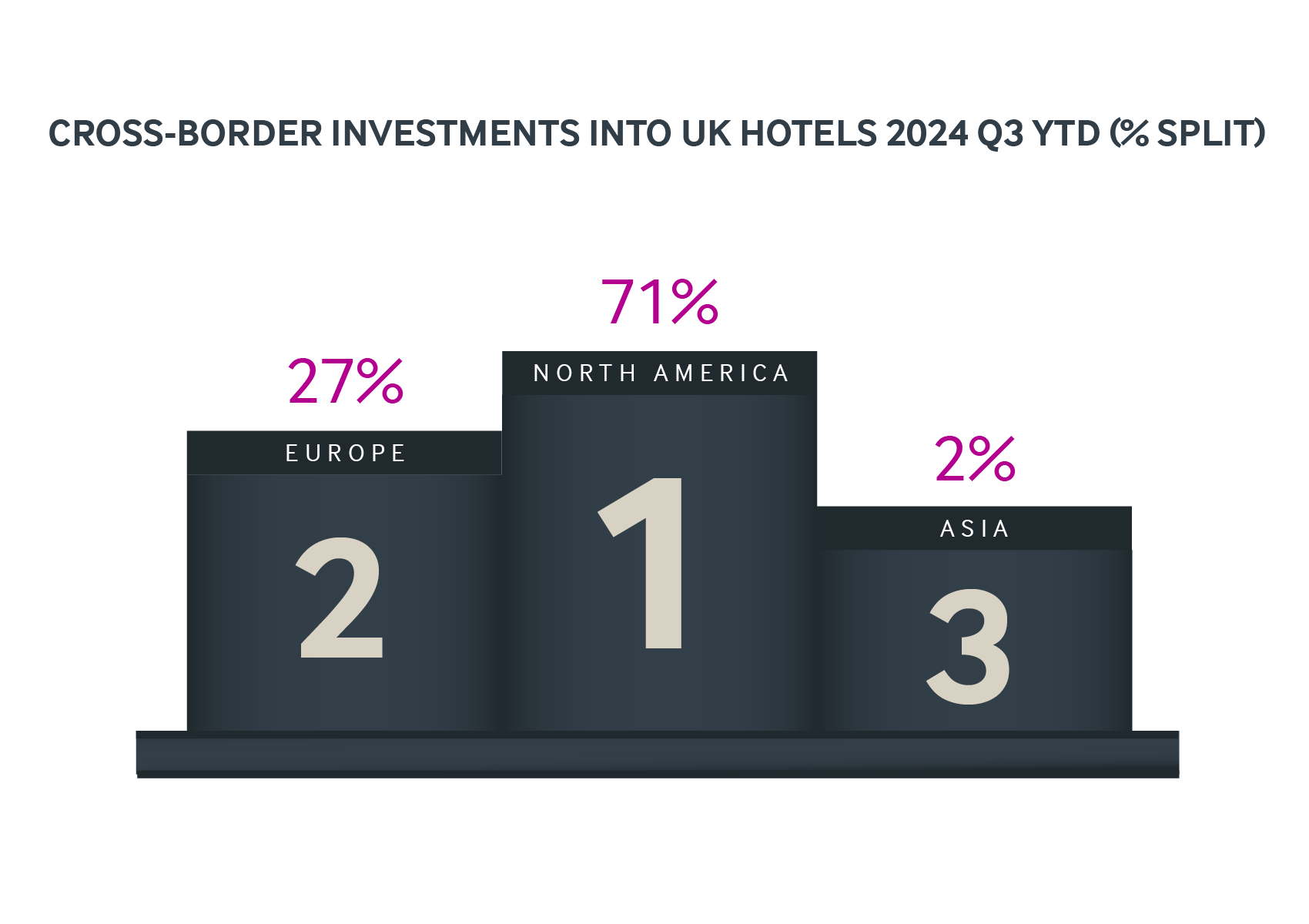

The slower growth in single asset transactions and in regional UK can be attributed to a “wait and see” approach of individual investors having assumed earlier and more significant cuts in Central bank base rates. This may well be further corrected in the last quarter of the year driven by these investors’ concern around taxation measures deployed by the new Labour government as part of the Autumn Budget. The share of cross-border investors rose from 49% to 66%, with American investors markedly dominating (71% of the total cross-border investment volume in 2024 Q3 YTD), and boosted by institutional American fund Blackstone’s purchase of the 33-hotel portfolio of Village Hotels for £780m, whilst overall cross-border investment volume increased fourfold from 2023 Q3 YTD.

Note: This graph shows Cross-Border Investments into UK Hotels 2024 Q3 YTD (% Split), as of 20 November 2024.

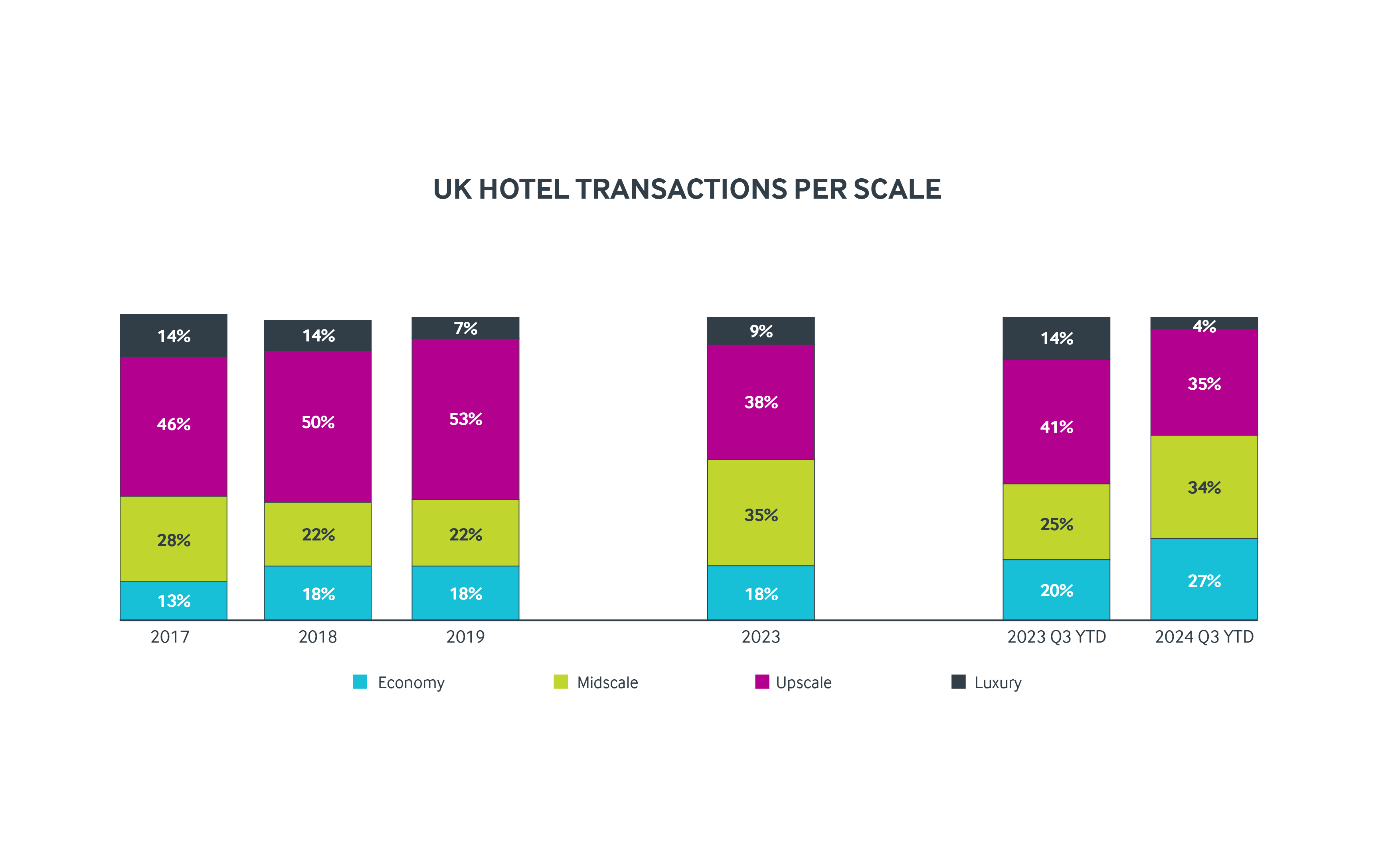

The composition of hotel investors’ shopping basket also evolved in 2024 Q3 YTD against the same period in 2023, with far greater concentration in the Economy and Midscale segments, reaching 61% of the overall transacted value, boosted by Travelodge acquiring 66 freeholds from the LXi REIT. The Upscale segment, on the other hand, represented about a third of the volume transacted in 2024 Q3 YTD, some 6ppts lower than the same period last year and below its historical 50% share over the period 2017-2019. This should nevertheless not undermine the significance of this segment approaching £1.6bn in 2024 Q3 YTD; about four times its 2023 level. More transactions closed over the summer, including the £230m portfolio of three London Residence Inns (495 rooms) by Scandinavia based fund Pandox from Starwood Capital.

Note: This graph shows UK Hotel Transaction Segment Composition 2017 – 2024 Q3 YTD, as of 20 November 2024; it includes transactions £2.5 million and greater. Sources: MSCI Real Capital Analytics https://app.rcanalytics.com/, Christie & Co Analytics

The increasing share of the Midscale segment and its more than six-fold increase in value transacted in 2024 Q3 YTD compared to previous year level, also confirms the prominent role of investors pursuing “value-add” strategies to repositioning hotel assets as development costs remain high. At the other end of the spectrum, the share of Luxury hotels was down to a quarter of its share in 2024 Q3 YTD. The single luxury transaction this year, the Six Senses London, contributed to a marginal increase in value over the combined £140m 2023 transactions of the Firmdale Covent Garden and Waldorf Astoria Edinburgh (The Caledonian).

Together with the improvement of financing conditions, and through Christie & Co interaction with a variety of investor profiles, it is our view that transactional activity in the hotel sector has also benefited from the further emergence of the hotel asset class as one of the few bright spots in the commercial real estate market, along with residential properties and data centres, largely because of their ability to combat rising costs with increasing room rates.

Following a brief period of trading stability and improved financing conditions, the Autumn Budget introduced further challenges for the hotel sector. The increases in Employer National Insurance Contribution and National Minimum Wage will have a temporary impact on the visibility of both buyers and sellers in this thriving sector.

"The recalibration of pricing and the softening of yields have been progressive since early 2023 and is starting to unlock deals,” said Jeremy Jones, Head of Hotels Brokerage. “The pricing gap between buyers and sellers has narrowed and there is more debt in the market for larger deals. With further interest rate cuts on the horizon, we anticipate improved liquidity in the debt markets in the last quarter of the year to support a wave of refinancing together with a progressive but slow sharpening of yields, all converging to increased fluidity in the UK transactional market."