The Independent Dental Market: Motivations and Impact

In this article, Joel Mannix (Head of Dental at Christie & Co) reviews the independent dental market in the UK and shares tips for anyone considering buying a practice in 2025.

Business. Built around You.

Your expert business property advisers

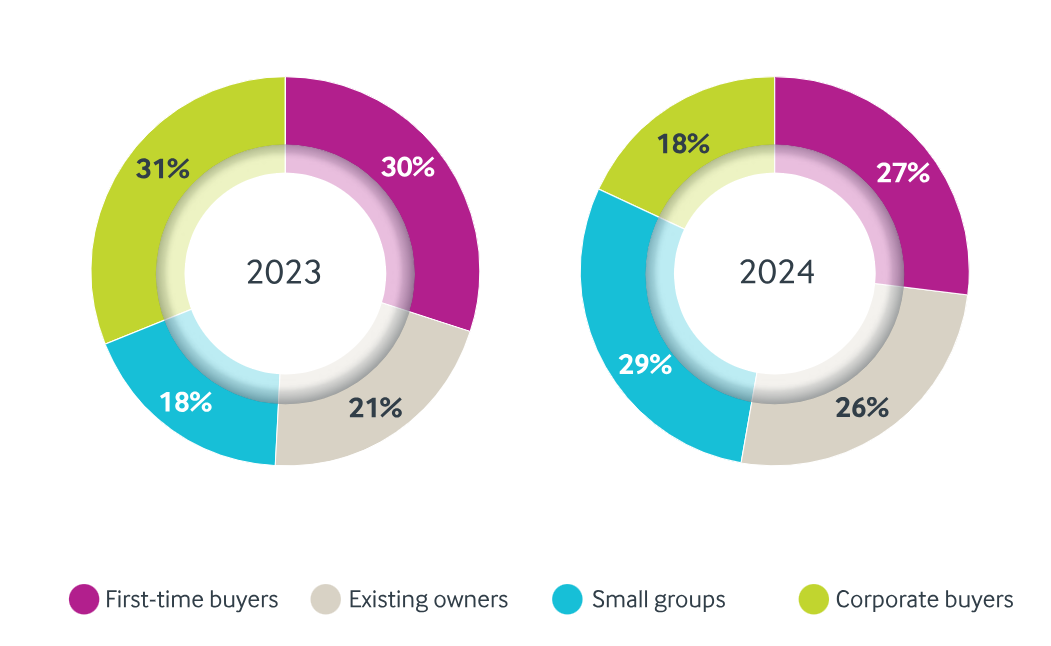

In recent years, the independent dental market has been an increasingly significant force in shaping the UK dental sector. With first-time buyers, existing owners, and small groups accounting for over 80% of dental practice sales in 2024, the independent segment has driven activity and dominated the transactional landscape. This blog post explores the motivations behind this trend, its impact, and the re-emergence of corporate appetite in 2025.

BUYER PROFILES

Source: Business Outlook 2025, Christie & Co

Motivations Behind the Independent Market

- Taking the step to own a dental practice can provide the security of income and the autonomy to make key decisions that align with professional values and vision. This control extends through various aspects of ownership, ranging from financial and operational decision-making to eco-credentials and sustainability in practice, and the adoption of new technologies and efficiencies. In owning a practice, dentists can positively impact not just those financial and business outcomes, but also far-wider in protecting the planet and operating in ways that reflect their personal commitment to innovation and operational excellence

- Financial Incentives: Despite economic challenges, the financial potential of owning a practice remains attractive. Independently-owned practices will often achieve proportionately higher margins of profit when compared with larger-scale, Associate-led practices. The ability to directly benefit from the financial success of their practice will commonly motivate many prospective buyers into exploring routes to ownership

- Stabilised Borrowing Costs: The recent reductions in interest rates have lowered the potential costs of borrowing, making it a more appealing prospect for buyers to finance acquisitions. Banks still see dentistry as a green-light sector, with many high-street lenders eager to lend to those looking to acquire dental practices

- Market Opportunities: The increase in the number of practices brought to market in 2024 provided a wealth of opportunities for independent buyers. With an 18% rise in available practices compared with the prior year, prospective buyers had a broad range of opportunities to consider, making it an opportune time to explore the market, where that increasing market supply is expected to continue through 2025

- Community: Independent practice owners often have a strong connection with their local communities. This engagement fosters patient loyalty and satisfaction

Impact on the Market

The dominance of the independent sector has had several notable effects on the dental market.

The influx of independent buyers has significantly heightened competition in the market. In 2024, sellers received an average of 4.8 offers per practice, up from 4.4 in 2023. This competitive environment has kept practice valuations robust, with practices selling for an average of 108% of their asking price. The strong activity from independent buyers has bolstered market confidence, with viewings surging by 19% on the prior year, offers received rising by 17%, and the number of agreed deals increasing by 26%. This confidence is reflected in the overall sentiment of dental professionals, where 37% of those we asked feel positive about the market in 2025.

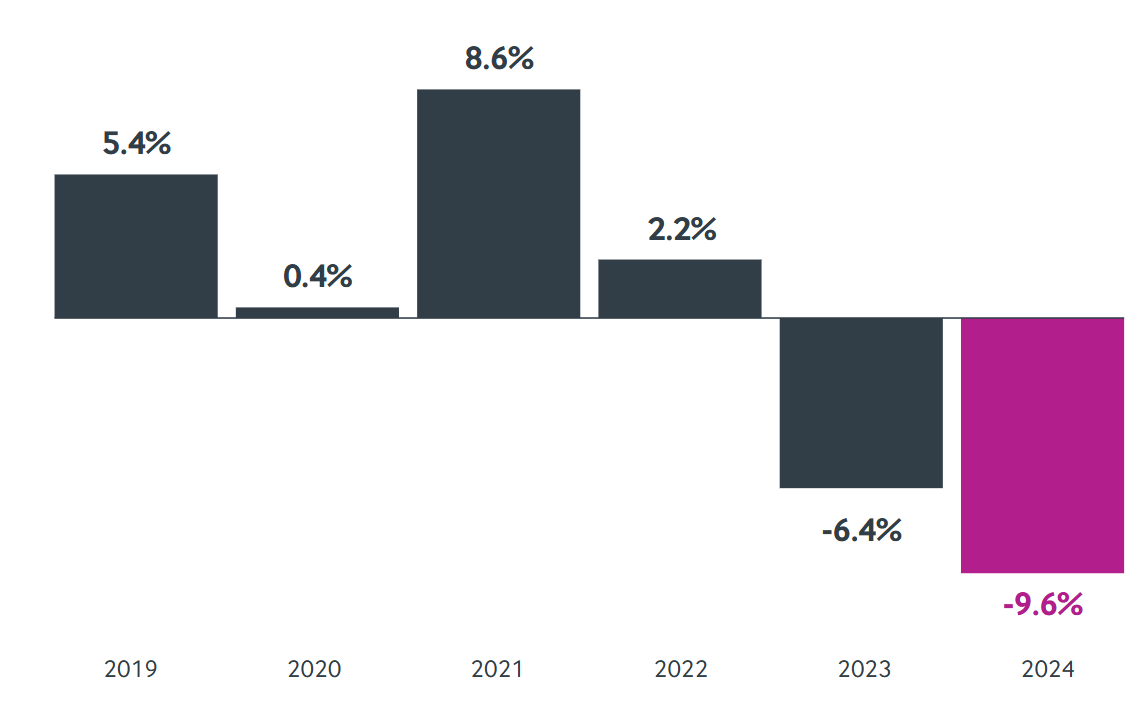

The average sale price of dental practices decreased by 9.6% in 2024. That is reflective of the robust activity within the independent sector, where the core volume centred around opportunities of a scale and value, suited to that segment of the market. That ongoing activity alongside the general stabilisation of the financial landscape through 2024 has been crucial in maintaining market dynamics, where both buyers and sellers can engage in transactions with confidence and clarity.

MOVEMENT IN THE AVERAGE PRICE OF DENTAL ASSETS SOLD, YEAR-ON-YEAR

Source: Business Outlook 2025, Christie & Co

Emerging Corporate Appetite in 2025

As we move through 2025, corporate appetite for dental practices is showing signs of resurgence, largely influenced by recent interest rate cuts. The Bank of England's decision to lower interest rates to 4.5% will make borrowing more affordable, creating a favourable environment for corporate acquisitions. Corporates are likely to continue reshaping their portfolios through mergers and disposals. The stabilised economic environment allows for more strategic decision-making, enabling corporates to focus on integrating and divesting assets effectively. With the financial barriers to acquisition reduced, corporate buyers are expected to re-enter the market with vigour, adding a dynamic dimension to the market that complements the ongoing activity from independent buyers.

The independent dental market has played a pivotal role in shaping the UK dental sector, driven by motivations such as autonomy, financial incentives, and community engagement. This trend has increased competition, bolstered market confidence, and led to average pricing adjustments. As we look ahead through 2025, those recent interest rate cuts and the resurgence in corporate appetite, this will no doubt add a new layer of activity to the market. With both independent and corporate buyers actively seeking opportunities, the dental market is poised for continued growth and dynamism.

For a confidential discussion about your sale options, get in touch: joel.mannix@christie.com / 07764 241 691