The UK pubs sector – prime for investment

The UK pubs sector has received some bad press in the past decade, and as a result can get overlooked by investors. In reality, the sector is currently in rude health, with excellent returns on the horizon.

Business. Built around You.

Your expert business property advisers

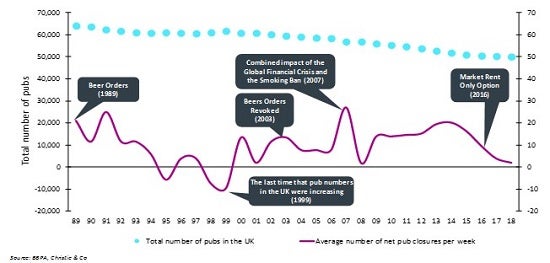

The past 30 years has been a volatile period for the UK licensed sector. Since the introduction of the Beer Orders in 1989, the market has experienced several economic and legislative shocks that have led to business owners calling time. The phrase “perfect storm” has been used twice in the past decade alone, first to describe the double whammy of smoking ban and economic downturn in 2007/8, and later in reference to the tidal wave of cost pressures that came into effect in April 20171. But is it all actually bad news?

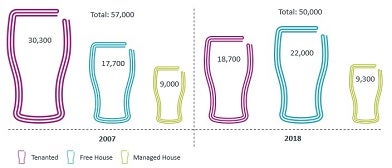

Organisations such as CAMRA have drawn attention to the decline in pub numbers over this period, from near 70,000 in 1989 to just 50,000 today. But the truth is, that the UK licensed sector was oversupplied, with too many “spit and sawdust” venues that were unable to keep up with the evolution of UK consumers’ attitudes towards eating and drinking. The near-20,000 pubs that we lost were mostly converted into convenience stores, restaurants, and residential use – as recently as six years ago more than a third of pubs sold went on to be converted for alternative use. The quality of the average pub today is undoubtedly much higher as a direct result of this restructuring.

Supply is now broadly balanced with demand, and the rate of pub closures has stabilised to nearly nil, with only 17% of pub sales leading to a conversion. In fact, established operators are actually building new pubs in several markets: Marston’s, McMullen & Sons, Everards, and many more well-known names are investing in a pipeline of purpose-built units – a strong indication of growing confidence in the sector.

As the sector shed its tail, and the big, overleveraged tenanted estates contracted, the private freehouse segment has expanded, absorbing about a third of these units. We’ve seen the pendulum of preferred operating model swing from tenanted to managed (and back) several times as the market has evolved – most recently due to concerns over the potential impact of the Pubs Code. Currently, we’re of a balanced mind set, and appetites for both managed and tenanted estates are good, with the franchised model also proving popular for smaller, wet-led units. It’s worth us pointing out that freehouses now make up almost half of the UK market - a prime opportunity for those willing to take their time and grow organically.

Underlying asset performance remains excellent2, and both the top and bottom of the market are seen as highly desirable, with envious growth in asset prices as a result. Our outlook for 2018 reflects this, with an expected value growth of between 4-8% for the average UK pub3.

In summary, the sector is in the best shape it’s been in for a while. Whether you’re an investor, operator or consumer, the UK pub is experiencing a renaissance – and that is certainly something to toast to.

1 – Cost pressures referred to included National Living Wage, Apprenticeship Levy, Pensions Auto Enrolment, and the Business Rates Revaluation, all of which increased costs in April 2017. Utility price rises, and cost inflation on the back of a weaker pound also impacted profitability during this time

2 – Managed house performance in desirable markets during 2015 and 2016 was quite simply stellar. Revenues grew a further 4% in 2017, with EBITDA holding flat, which we consider outstanding performance in the face of the number of cost pressures that came into effect per above

3 – An important caveat here is that value growth will vary materially by geography, operating model and asset class