Hotel Market Insight: Flurry of independent hotel sales in Scotland signal the country's growing appeal to investors

In this article, Gary Witham, Director - Hospitality Scotland shares an insight to the Scottish hotel market, which has experienced a flurry of independent hotel sales in 2023.

Business. Built around You.

Your expert business property advisers

The Scottish hotel market has experienced a flurry of independent hotel sales in 2023, signalling Scotland’s growing appeal to domestic and overseas investors.

The uptick in sales is underpinned by a robust post-pandemic recovery, driven principally by leisure market demand, with data from Christie & Co’s latest hotel report, UK Hotel Market Snapshot 2023 H1 revealing that Scotland has become an increasingly popular tourism destination.

According to the report, airport traffic and ADR have increased significantly in Edinburgh and Glasgow since 2019 and leisure-led hotels have performed well over the last 12 months. In the capital, airport traffic and ADR increased by 39% compared to 2019 and Glasgow’s figures were similar, with airport numbers up 21% and ADR up 20%. This growth is also evident in regional destinations such as Aberdeen (albeit from a low base) and Inverness, where visitor numbers have surged in 2023, due to staycation demand and the now internationally known NC500.

Since Q2 2023, several high quality, privately-owned hotels have sold to a range of private and corporate investors, demonstrating the resilience and buoyancy of the independent Scottish hotel market.

Christie & Co’s Scottish Hospitality team has been involved in 70% of these key independent hotel deals, which have ranged from completely off-market to full open-marketing processes.

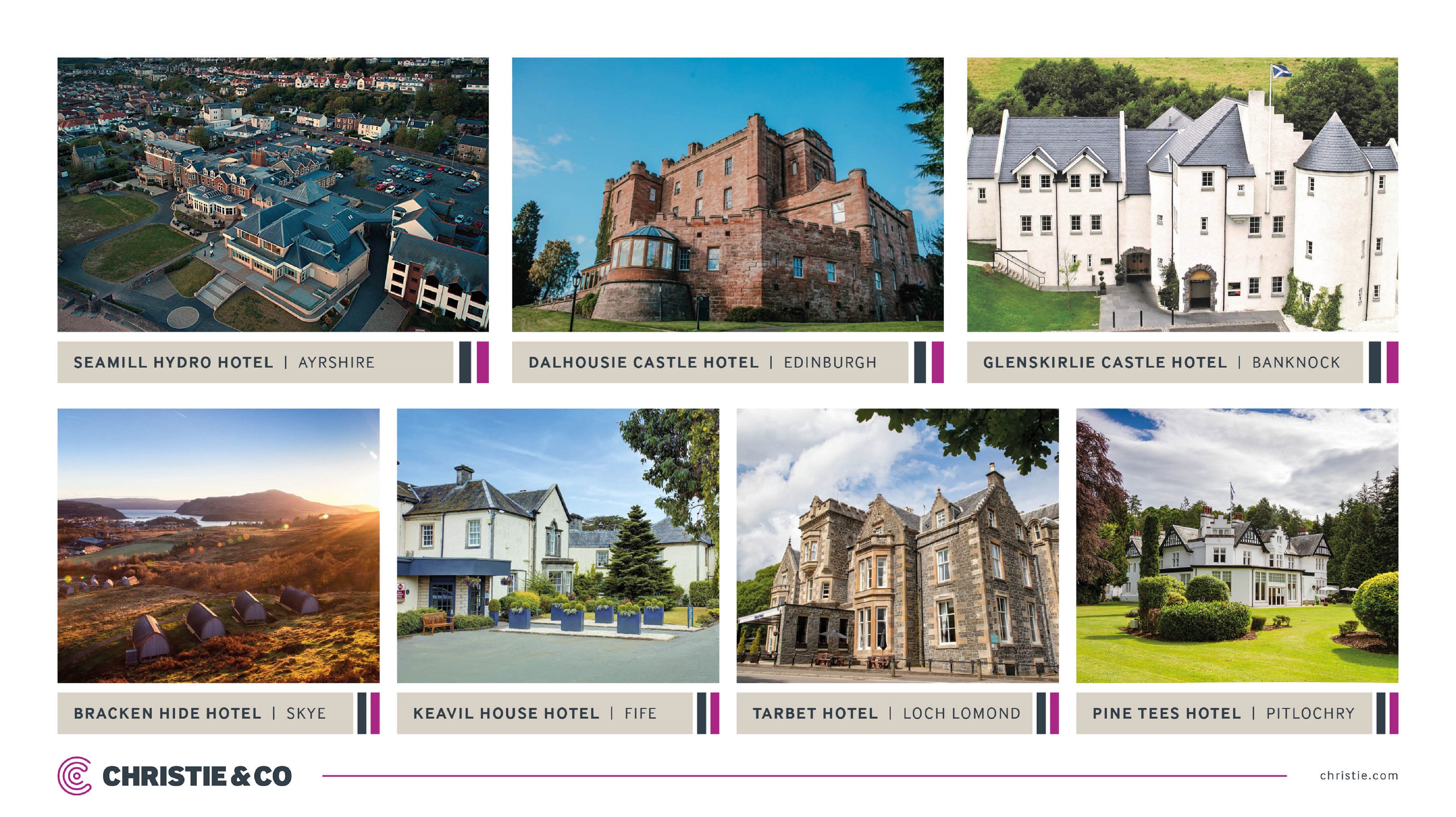

This includes the famous Seamill Hydro Hotel in Ayrshire, which was sold in an off-market deal to fast-growing RAD Group and Dalhousie Castle Hotel in Edinburgh, which was acquired by private US investors following an open-market process.

Independent hotels in Scotland sold by Christie & Co - 2023 YTD

In comparison, corporate market activity remains subdued due to challenges around debt funding. However, two key deals to date have included the sales of The Caledonian Waldorf in Edinburgh to Henderson Park and Crerar Hotel Group to Blantyre Capital / Fairtree Hotel Investments, which indicate Scotland’s appeal to private equity groups.

According to our team, buyer demand is two-fold: well-priced assets that offer immediate yield have proved particularly attractive to an increasing number of overseas buyers from South East Asia in particular.

Additionally, there is strong appetite for hotels with value-add opportunities, of which there are many in Scotland, as much of the country’s hotel room supply is in need of refurbishment and asset repositioning, according to data in the UK Hotel Market Snapshot 2023 H1 report. This is likely to be contributing to the interest in Scotland’s independent hotel market.

The encouraging market activity seen in recent months demonstrates the growing appeal of Scotland’s independent hotel market to investors, despite challenging market conditions.

Buyers remain hungry for well-priced opportunities, especially leisure based, room-led operations. Hotels with scope for development and growth are also attracting plenty of interested buyers, with lodge and other eco-developments proving increasingly popular.

Christie & Co has access to a vast array of buyers through our network across the UK and mainland Europe, making us well-placed to tailor a marketing process to suit the needs of your business.

To find out more about the hotel market in Scotland, or for a confidential chat about your business options, contact us.

GET IN TOUCH

Brian Sheldon

Regional Director - Hospitality Scotland

M: +44 (0) 7764 241315

E: brian.sheldon@christie.com

Gary Witham

Director - Hospitality Scotland

M: +44 (0) 7712 198 834

E: gary.witham@christie.com

Do you require funding? Our colleagues at Christie Finance can help

Arranging finance for hotels with high street lenders has become increasingly complex, as many banks have adopted a more cautious approach to lending in the sector due to the economic and operational headwinds facing hotel operators. In recent months, interest rate hikes have also impacted many buyers borrowing ability. However, several challenger banks have entered the market with competitive terms for both existing operators and new entrants.

The Christie Finance team can review your individual business needs and arrange tailored funding advice, to help you realise your goal of buying a hotel in Scotland. Get in touch with the team to find out more.

Craig Dickson

Director – Christie Finance

M: +44 (0) 7713 061 621

E: craig.dickson@christiefinance.com