Hospitality Industry Challenges: Future Outlook

In the third and final instalment of our blog series examining economic and operational challenges, we look ahead to the future and how the industry can adapt and thrive.

Business. Built around You.

Your expert business property advisers

Agility and Adaptability as Solutions for the Future

Hospitality businesses had to adapt quickly to the constantly evolving landscape of covid restrictions and as a result, new ways of operating have emerged. With limited and uncertain demand levels, staff shortages and pressures to contain costs, many businesses have adopted digital solutions. An increased number of businesses offered solution such as apps for table or room service, self-check-in at hotels and providing take-away food via multiple distribution channels (e.g. Deliveroo, JustEat, UberEats, etc.). While restructuring their staffing requirements to operate a leaner, more agile staff roster without compromising quality and customer experience.

Simultaneously, investor’s mindsets post Covid has shifted to support investment in technology and ESG, both at the forefront of a growing number of key players’ investment strategy in the hospitality sector. Landlords and operators alike have started to invest in sustainability projects such as combined heat and power (CHP), solar panels, hydrocarbon water filtering systems, energy efficient materials and finishes and various others in order to reduce not only their carbon footprint but also their energy bills.

Government measures introduced during the 2021 Budget included capital allowances for capex investment, which has made investment into such technologies more attractive. Many hospitality businesses, in particular hotels, moved quickly and used the forced closures and subdued demand to implement capex improvement plans that would have otherwise been executed over the coming years, offsetting some of the revenue losses with potential gains once demand returns. While the return on capex investment can be gradual, often such investment will generate long-term gains as they contribute to costs reductions, enhance the brand and property appeal, and ultimately attract higher yields.

The Recovery Curve

The pandemic has had a profound impact on how the hospitality industry operates and most importantly how demand is forecast. Not only did hospitality establishments have to navigate an ever-changing landscape of Covid restrictions, but also a shift in demand patterns and guest behaviour. Even though the vaccine rollout in the UK and Europe has restored some level of confidence in travel and a return to social environments, the rapid evolution and adaptation of video calls, hybrid working, online business meetings and conferences have forced management of hospitality establishments to become highly adaptable in their business model.

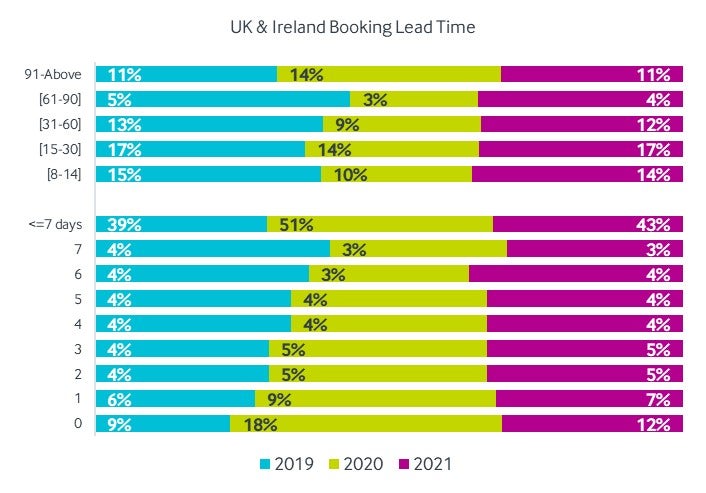

According to the latest report from Amadeus[1], at the peak of the pandemic in April 2020, 62% of all bookings worldwide were made less than 7 days before departure. The short booking window made staff scheduling, revenue management and on-site operational planning extremely difficult. While lead times have slowly improved with the return of travel from mid-2020, as of December 2021 the lead times for 44% of bookings remains below 7 days.

Source: Amadeus

However, forward booking data for domestic and international flights is showing signs of improvement, which will hopefully translate into an upward trend in hotel bookings. Travel restrictions imposed during the initial stages of the pandemic significantly reduced intraregional and international travel, which led to a boom in domestic “staycation” demand across most European markets.

In the UK, whilst the summer demand boom in 2020 was fairly short-lived from July to October, both occupancy and ADR were still significantly behind 2019 levels, although some leisure destinations, especially coastal towns, surpassed 2019 levels in some months. In 2021, however, the picture looked markedly different. For the months between August and November 2021, Regional UK achieved occupancy levels of between 91% (October) to 94% (August) of 2019 levels with ADR surpassing 2019 by up to 20% (October). City destinations on the other hand saw a much slower recovery curve with demand only slowly returning from Q3 2021 onwards, as business and MICE demand remained low and travellers slowly regained confidence in city breaks. In London, ADR in November and December 2021 was just shy of 4% below 2019 levels, even though occupancy remained more than 20% below.

While most recovery forecasts steadily improved over the course of 2021, mostly due to the rapid vaccine rollout and progressive easing of travel restrictions, the emergence of the Omicron variant and resurgence of cases and travel restrictions towards the tail end of 2021 put a damper on those forecasts. Oxford Economics downgraded their recovery forecast in November, now estimating a return to 2019 levels at the end of 2023/beginning of 2024, whereas in their July forecast that return was expected to happen at the beginning of 2023.

The combination of the above factors is likely to lead to an increase in consumer prices over the next year as hospitality business try to recover lost revenue and tackle increasing costs. A survey by UKHospitality found that 47% of operators reported they were being forced to increase prices by more than 10% in 2022 with a further 15% anticipating a hike of more than 20%. These price increases will further add to overall inflation as hospitality carries a proportionately larger weighting in the CPI.

The Light at the End of the Tunnel

As the world learns to live and cope with the Covid-19 virus and slowly shifts its mindset and daily life into endemic mode, the outlook for the hospitality industry looks positive. Yes, the pandemic has turned the world upside down, changed lives and behaviours, likely for the foreseeable future, but it has first and foremost reinforced the notion that humans are social animals. And that we want to travel the world – whether to see family, conduct business or get a change of scenery. The rush to book holidays as soon as a reduction in travel restrictions (both at home and in key holiday destinations) was announced shows that there is significant pent-up demand that is just waiting to be released. Also, on a more logical and realistic note, the governments of the world cannot continue to restrict lives and economies for much longer as the human and economic costs of the Covid-19 pandemic so far have already been enormous. Plus, they are eventually running out of money to support the economy.

Hospitality businesses will find ways to operate more efficiently, adapt to changing environments and customer demands. Landlords and lenders will become more adept in managing unforeseen changes in the business models of their operators and tenants. Operators and investors are willing to invest more in technology that reduces operating costs. And hopefully, all stakeholders, including the government, will recognize the important of the hospitality industry to the country’s economy and everyday life and implement reforms that offer support to combat the most imminent problems and help it thrive in the future.

[1] Amadeus, 2021 Forward looking data insights

https://www.amadeus-hospitality.com/uk/2021-uk-forward-looking-data-insights/