Hospitality Industry Challenges: Covid-19 impacted annual turnover?

As reported in our annual Business Outlook 2022 Report, economic and operational challenges were a key theme for hospitality businesses in 2021. Headwinds including inflation, staffing issues and supply chain disruptions continuously impacted revenues and put pressure on profit margins throughout the year. Over the next three weeks we will take a deeper look into these challenges and how they might shape the hospitality market in 2022. In this week’s blog, we review Covid-19’s impact on annual turnover.

Business. Built around You.

Your expert business property advisers

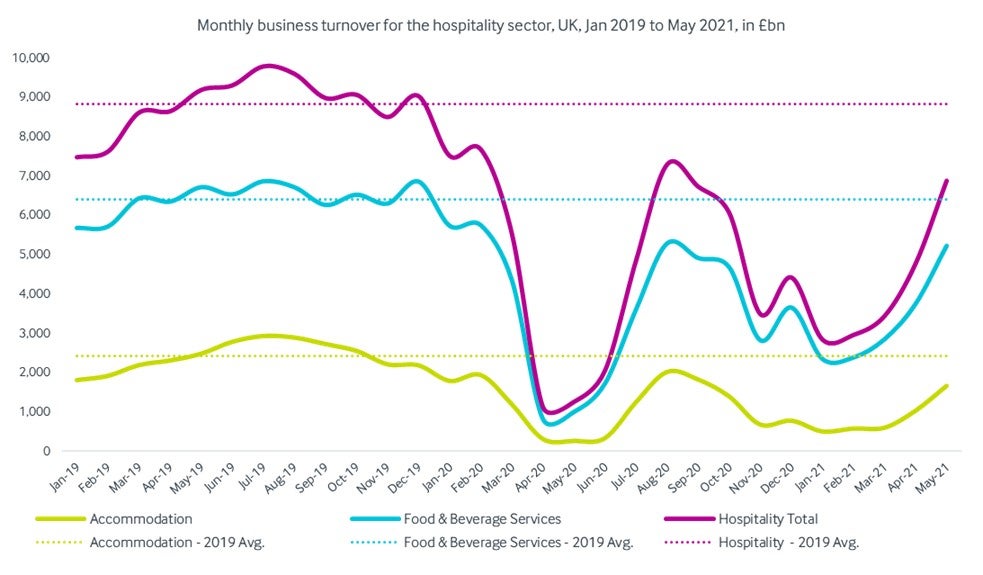

The hospitality industry has been one of the most affected industries during the Covid-19 pandemic, with the estimated full year loss in turnover in 2020 reaching c.53% for accommodation establishments and 42% for food and beverage venues compared to 2019 levels, according to the Office for National Statistics (ONS). For the period of January to May 2021, whilst the UK was in its third national lockdown, the ONS reported a loss in turnover of 60% and 46% respectively compared to the same period in 2019. While most accommodation businesses in the UK have now reopened, many food and beverage establishments have closed permanently or have yet to reopen, particularly in business districts as footfall is still not back to normal levels due to the shift in working habits.

Source: ONS

Changing Winds in the Labour Market

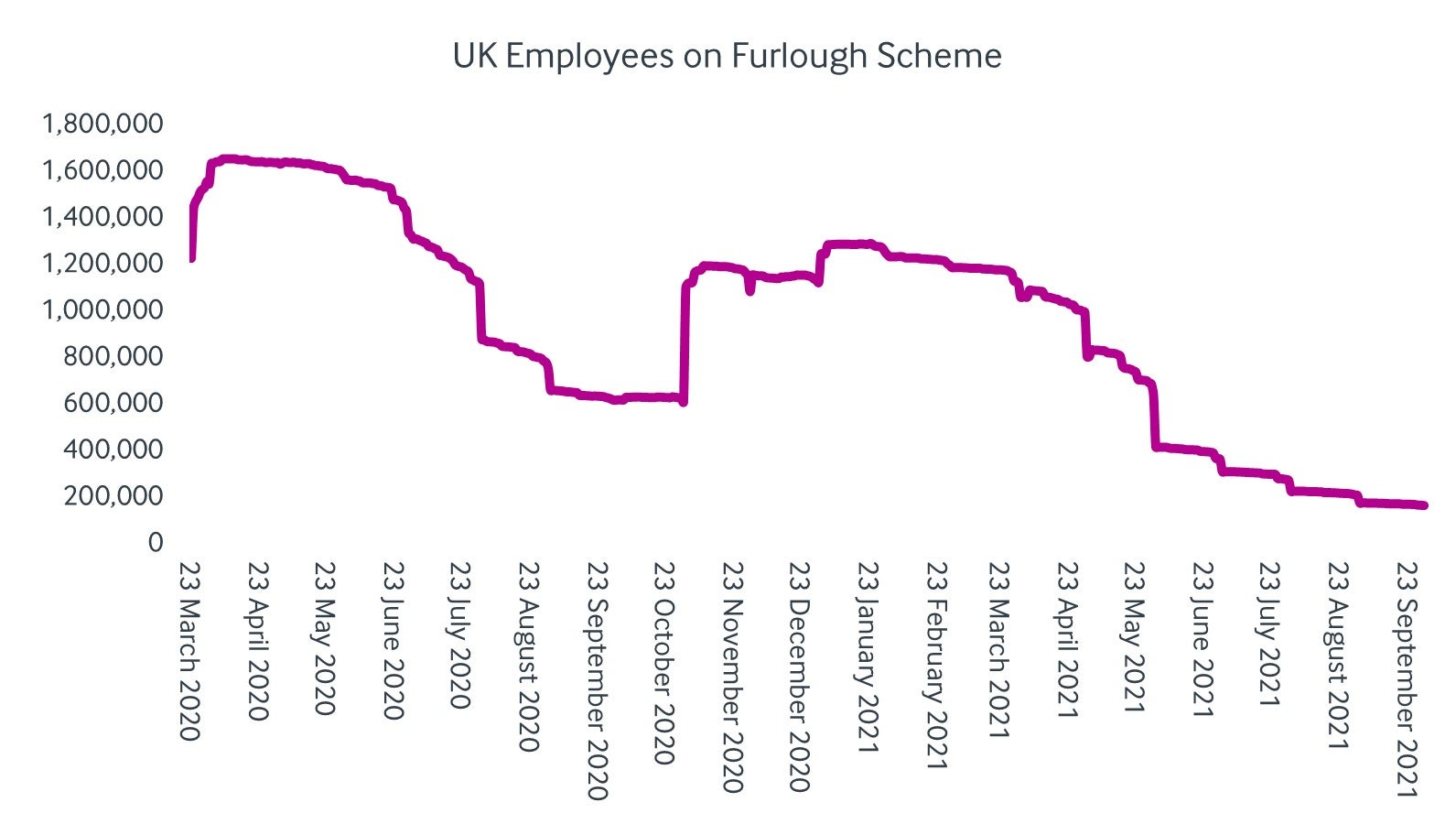

The severe loss in turnover suffered by the hospitality industry as a result of Covid-19 has had a ripple effect on the labour market. To combat this, the government’s furlough scheme introduced in April 2020 provided extensive support to most businesses and prevented a wave of job losses. Over 1.6 million employees were placed on furlough when the scheme was initially introduced, with figures from HM Revenue and Custom showing that these numbers fell to c. 156k when the scheme was closed in September 2021.

Source: HM Revenue and Custom

While the furlough measures protected a significant portion of staff wages and reduced the cost burden on employers, the pandemic, together with other external factors ultimately brought about a perfect storm of additional staffing challenges, namely staff shortages and rising labour cost.

External factors such as Brexit also play a role on the current UK labour market conditions. Indeed, since January 2021 additional regulations regarding the right to work, visa requirements and sponsoring licences have increased barriers to entry for EU nationals exponentially and therefore amplified labour shortages. This is evidenced in the latest figures published by Fourth[1] − since January 2020, the proportion of EU nationals working within the hospitality industry has repeatedly declined to reach its lowest level at 31.2% in June 2021 against 43% in 2016. Many EU nationals who lost their jobs due to Brexit or the pandemic left the UK and have since not wanted to or been able to return. Additionally, many employees (and not just those in the hospitality industry) that were put on furlough have left the labour market by pursuing further education or moving on to other careers, often with better progression or remuneration prospects.

As a result, many UK businesses are finding it difficult to fill vacancies as demand returns. Data published by the ONS in January 2022 revealed that 31% of hospitality businesses found vacancies more difficult to fill between July 2021 and January 2022. Furthermore, the number of vacancies within the hospitality industry has grown above the 4% historical average to 7.4% for the period from October to December 2021.

The Business insights and impact on the UK economy [2] published in January 2022 shows that 65% of the respondents within the hospitality industry had to either pause trading partially or entirely or were unable to meet consumer demand due to staff shortages. In response, 59% increased their current employees’ working hours to compensate for the lack of workers. In addition, 51% of respondents also indicated the increased difficulties to fill vacancies within the hospitality industry were due to a limited ability to offer attractive pay packages, and 27% noted it was due to the reduced number of EU applicants.

Source: ONS

[1] Fourth, The Hospitality Workforce Report November 2021

[2] ONS, Business insights and impact on the UK economy BICS Wave 48 – 27 January 2022